So how does this affect you? In every way, it affects you.

The Baltic Dry Index (BDI) at the time of this writing is at 345. This indicator measures the costs of resources and raw materials shipped worldwide. As you probably are aware, the cost of a barrel of crude oil has been in decline since last year, with the price hovering around $30 per barrel currently. The problem is with the oil companies and oil exploration and drilling firms. Many of them are in default and most in the red for the year.

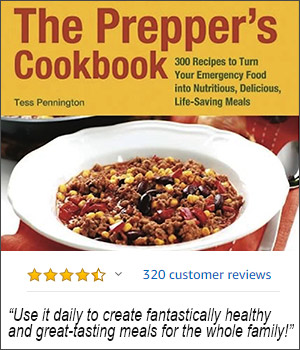

Just the other day it was revealed that 47 American drilling firms filed for bankruptcy. All of this is significant in every realm of the economy, and for you personally. For a really good eye-opener on just how significant all of this is, I encourage you to read Tess Pennington’s article, “When the Trucking Stops,” to tie in all of these price fluctuations and contracts that cannot be exercised, causing a cessation in the flow of goods.

Macro – and Microeconomic Factors To Look At

So what, you may ask? So there are a few things you can watch from a Macroeconomic perspective to give you the “heads up” on when things are really going into the end-game, and they are as follows:

- As mentioned, the BDI: the most accurate tool you can use, as these raw materials drive virtually every industry in the world.

- As mentioned, the price of crude oil per barrel…oil drives the world’s economies…and therefore drives the world

- Precious metals: what you’re looking for a substantial rise or fall in the spot price per troy ounce…and also, concentrate on what the nations are doing…buying a lot or selling a lot of it

- T-Bills and Treasury securities: other countries buy our debt, such as Japan, China, and Great Britain. When countries begin to dump these securities and cash them out, it shows they either lack confidence in our money or in our economy. Research will show that several nations have made large dumps within recent months

- S. Corporations relocating: recently, Coca-Cola’s main bottler announced a decision to move to Ireland, as did the firm Johnson Controls, to avoid the increases in taxes by the U.S. government…significant in the fact that the domestic tax base is reduced, as well as domestic manufacturing/production (in an already 80% consumer-driven economy).

- Severe market volatility: this isn’t the regular “belching” of a few hundred points up or down…but major movements either all at once or successively over a period of days.

- Government-Instituted Cash Controls: A nationwide “bank holiday” and bank closures, directed by the Federal Government. This also includes cash controls at the nation’s borders and airport terminals…this is a very late sign. If you see this? Then you need to batten down the hatches because the storm is imminent.

Microeconomic factors are the ones you can more readily see in the immediate locale where you live. The list is much longer, as there are an infinite amount of variables just as there are variances in geography and demographics that influence them. Here are a few that you can use, always remembering to tie them into the macroeconomic factors for the complete picture. Some are as follows (this list is by no means complete):

- local businesses shutting down in large numbers

- prominent local businessmen and leaders leaving the area/state

- grocery stores and big-box stores bereft of necessities and inventory

- the price of food and necessities rising astronomically

- layoffs and unemployment notices locally

- your local bank beginning to institute forms of rationing or checks/controls

- an increasing amount of social unrest

- cessation or severe curtailment of regular shipments of goods (food, gasoline, medicine)

Many of these things are beginning to be seen now, as the United States economy continues on its downward spiral. By looking around you at the big picture as well as the snapshot in your immediate locale, you give yourself better odds at having a fighting chance to pull the plug at the right time. Common sense and scrutinizing observations must go hand-in-hand. Keep your eyes open, and keep up the good fight. JJ out!

This article was originally published at Ready Nutrition™ on February 2nd, 2016

Keep this in mind. Layoff’s, store closings, businesses opening and closing, holes in store inventory is the new reality.

When you see DELIVERY companies start to layoff, especially enmasse, THEN you know we’re short for bad things. Once UPS and FedEx announce layoffs (not just post-Christmas) then you need to do final stocking and purchasing because that’s the slap in the face that we’re ‘here’.

And, please, don’t leave cash in the bank if you don’t have to. No sense in leaving it in there for the banker hands to take it and still pay themselves million dollar bonuses.

An old Vietnam Vet here.

I started planning my get away from the US in the 1980s. I had already a place high in the mountains that still stands and used by my grown children. Nevertheless, I left the US in 2009 and although visit, stay out.

I suggest you do the same if you can. Presently live in a South American country and my retirement buys 5 times what it does in the US. Not always, but most of the time, nevertheless, far above what I could have there.

And now wishing to return for some of my children and grand children.

An EMP is excellent cover for a nuclear missile attack. It just requires about 30 minutes of total communication loss for delivery.

Collecting and hoarding food or firearms inside the United States is like a bucket brigade for the Titanic when it was going down. Too little and too late.

If you stay in the United States its a guaranteed your dead, I don’t care if you’re in Montana’s mountains or Colorado’s Alpine Valleys. Your dead and will reach Canada and Mexico’s frontiers.

And these silly jackals trying to sell you water filters and survival food are just that, silly jackals trying to make a dime out of your fear.

The more one knows, the more one realizes the insanity of the US Government and its Elites.

Nevertheless, what’s on the horizon there is no way you or anyone else will survive it inside the United States. If you attempt, it’ll be your last intent at an attempt!

I want out of the US, but I don’t have a zillion dollars to pay a “relocator.”

Would you be willing to help “we the little people” to relocate maybe in a neighborhood near you?? That would be wonderful!!

I look forward to your reply!!

Best wishes!

Hi,

Patrick is away but on his return will respond to your email. Your email is important and at the next opportune moment he will respond. Thanks.

Patrick

Dearest Clark,

Thank you for your email. I can be reached at my full avatar name at g – m -a-i_l.Looking forward to hearing from you!! PS. need to know about domestic pets (dogs and data) and farm animals (goats, chickens, guinneas,) to bring with us.

Hi,

Patrick is away but on his return will respond to your email. Your email is important and at the next opportune moment he will respond. Thanks.

Patrick

Me toooo!

Dearest Joan,

I happened to send an email out to someone with a friend who helps (for free). He is out of country (travels around a bit), is 70, feels 45, has helped others and had only good things to say. It sounds like there are “neighborhoods” where former US citizens have migrated. A friend is managing his inbox as he is away at the moment. You may be able to get on his radar screen at clarkston@hushmail.com.

Best wishes!

StarFire

ANOTHER collapse prediction – OMG! Yes, ANOTHER collapse prediction – maybe, just maybe they’ll get it right – eventually; yeah, that’s it – the world will end, so keep on predicting that.

Can you enumerate those conditions as a short summary. The 29 crash was due to primarily two reason: no limits on margin trading, and everyone had a financial interest in the markets – everyone – your barber, doctor, house painter – hell, parents were even doing this on behalf of their infant children.