For the most part preppers are already very well acquainted with gold and silver. I don’t think you could study prepping for any significant amount of time without being inundated with opinions and analyses on what these metals may be worth during a crisis. However, most people are completely unaware that there are other precious metals you can buy. Aside from gold and silver, they might know about platinum and palladium, but would be dumbfounded if you ever mentioned anything else.

For the most part preppers are already very well acquainted with gold and silver. I don’t think you could study prepping for any significant amount of time without being inundated with opinions and analyses on what these metals may be worth during a crisis. However, most people are completely unaware that there are other precious metals you can buy. Aside from gold and silver, they might know about platinum and palladium, but would be dumbfounded if you ever mentioned anything else.

One precious metal that has been flying under everyone’s radar for decades is rhodium. You’d be forgiven for not knowing about it. Though it is occasionally used to coat jewelry, it has very little presence in the global jewelry market. Unlike silver, it’s not a critical component in electronics or industry. The only thing it’s widely used for is as a component for catalytic converters.

It does however have a lot of the qualities that would make it a good precious metal investment. It’s hard, durable, portable, and has a very high corrosion resistance. It’s definitely something you can buy and stash away without worrying about it degrading. More importantly though, rhodium is incredible rare. In fact, it’s the second most rare naturally occurring substance on Earth.

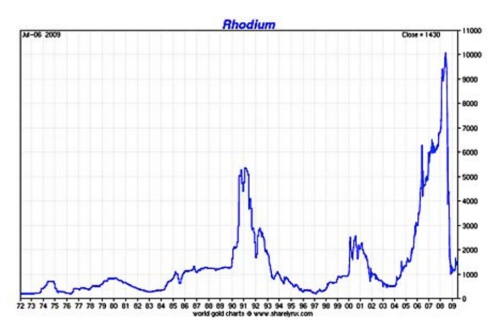

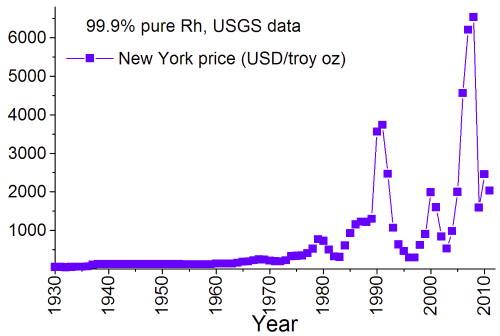

And that rarity is both an advantage and a disadvantage from an investing prospective. Annual production of this metal is very small, which tends to create an environment of price volatility. There’s a lot of potential here for profits, as well as horrendous losses if you buy it high. Not too long ago the price spiked to $10,000 per ounce before the financial crisis of 2008 dragged it back down to around $1000 per ounce.

But aside from those spikes, the metal has managed to keep pace with inflation, so it is still a decent store of value when it’s bought at the low-end.

The other glaring problem with the rarity of rhodium is its liquidity. Since very few people know about it or own it, there aren’t very many sellers. That unfortunately means that there aren’t very many buyers. If you try to wait for the price to spike before selling it, there’s a decent chance that the price will plummet before you find a buyer.

One really nice plus with Rhodium though, is that you can’t buy it on the stock market. There aren’t any paper contracts for it. If you want to invest in rhodium, you have to buy it in its physical form. This means that large financial institutions can’t easily manipulate its price, unlike gold and silver. Its value is always reflected by solid economic realities.

Another positive aspect of Rhodium is that it isn’t tightly pegged to gold. Its price doesn’t normally fluctuate with that precious metal, and there’s a really nice opportunity there. If gold goes up drastically, you could probably sell it and put the money toward rhodium while it’s low, and wait for that price to go up before selling.

But the most interesting aspect of this metal is what could influence its price in the future. Because it’s so rare there are only a handful of countries that produce it. South Africa produces more than 80% of the world’s Rhodium supply, followed by Russia with around 9%. You might notice that these are both very problematic countries.

Given current geopolitical tensions between the West and Russia, it would be no stretch of the imagination to assume that at some point, their rhodium supply could be cut off from the rest of the world. But that’s small potatoes compared to South Africa.

This is a country run by radical leftists that is teetering on economic collapse at any given time. Both public debts and inflation are at record highs, and their infrastructure and public services are crumbling at an alarming rate. To top it all off, South Africa is rife with ethnic and political tensions. The country is a powder keg slipping into a third world status. That instability could result in a serious rhodium supply crunch in the years ahead, which would of course result in very high prices.

So keep a close eye on this metal. While rhodium lacks the stability and historical precedence of gold and silver, there’s no denying that its price has a really good chance of reaching astronomical levels in our lifetime.