But how much longer can they prop up our financial system? Economic advisors such as Martin Armstrong, developer of the Economic Confidence Model, theorizes that boom-bust cycles occur once every 3,141 days, or 8.6 years (the number pi multiplied by 1000)

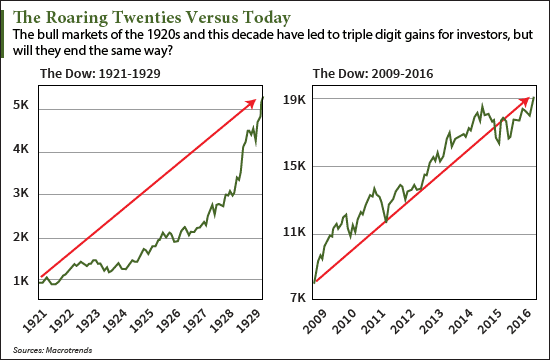

There are strong parallels to this current market and that of the stock market crash of 1929. Stocks are overvalued and have shattered record highs in recent years and only seem to continue climbing. But, as history dictates, what goes up will come crashing down.

So when will we see this financial crash? Zang states that in the next five years, the central bankers will put mechanisms in place to pull the plug and issue a massive reset. Anyone with a brokerage account, 401K, pension, IRA, or any wealth held inside of the system will be wiped out. The system will be reset. This sounds eerily similar to the Greek crisis, doesn’t it?

In an interview with Greg Hunter from USA Watchdog, Zang goes into detail of what to expect when this current financial cycle resets and explains the warning signs she saw that triggered these startling predictions. Folks, it’s not pretty.

If You’ve Yet to Prepare, the Time is Now

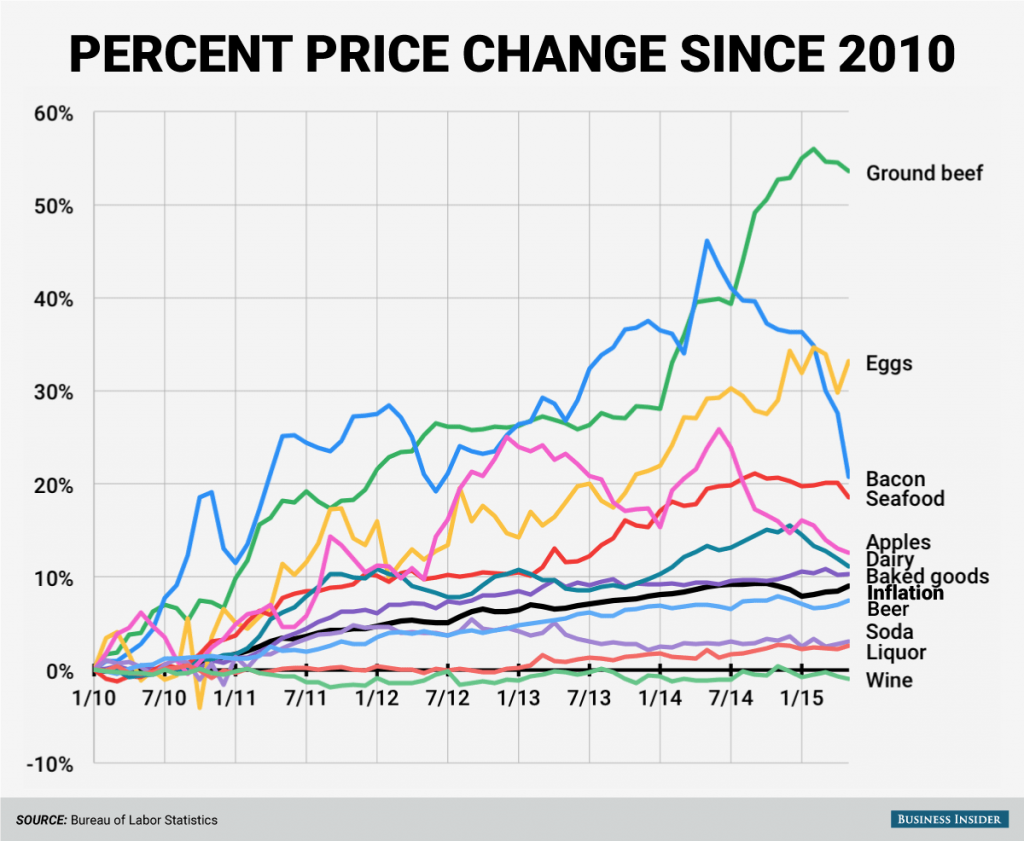

Unlike the recession of 2008, this economic beast will not be held off. There will be extensive amounts of wealth lost leading to drastic cutbacks by consumers. As well, you can anticipate food prices to increase even more than they have over the last few years. In fact, the price for food has drastically risen since the last recession; and according to this chart, prices are set to steadily increase with this next crisis.

How to Limit Your Exposure to the Next Financial Crisis

- Get prepared. At the very least, buy food, products, and supplies in bulk to help you prepare for price inflation. If you have the means to do so, invest in 30-60 days worth of supplies so that you have everything you need. Having these on hand will help you if times become more difficult. This best-selling book, The Prepper’s Blueprint is a step-by-step reference manual to help insulate you from these types of emergencies. As well, if you can manage, get out of debt, organize your finances and find ways to free up some of your income for an emergency fund to help you create a personal safety net – but keep it out of the banks and out of the market.

- Look for secondary events. When the system itself is no longer able to support the tens of millions of Americans secondary events will only increase. Events such as travel restrictions, wealth confiscation, food shortages, squatters rebellions, riots, and martial law.

- Preserve wealth. Choose hard assets (dry goods, precious metals, land, livestock, skills, etc.) for long-term investments so they will hold their intrinsic value over time. Holding these types of investments will insulate you from inflation and other economic losses. Further, tying your money up in assets will help you avoid the inflating prices of food sources in the future, thus furthering your cause of self-reliant living.

- Invest in food. One thing analysts and financial pundits agree on is that, in general, commodities will continue to rise. Using a combination of shelf stable foods, you can create a well-rounded food supply to depend on when an emergency arises. Further, these foods last a lifetime and would make sound investments for future planning. Ideally, you want to store shelf-stable foods that your family normally consumes, as well as find foods that are multi-dynamic and serve many purposes. Dry goods like rice, wheat, beans, salt, honey, and dry milk will provide you with an investment that will grow in value as prices rise, and also offer you peace of mind in case the economy further degrades.

- Learn how to grow your own food. In a homestead environment, a person wants the land to work for them as much as possible. Invest in fruit trees, seeds, and garden supplies. If you really want these peak foods, find a way to grow them yourself. Further, if you live in a rural area, consider investing in trees and bushes that will lure wild game. The trees and bushes can provide you with added sustenance and help you stock meat in your freezer. Here is a how-to guide for creating a garden quickly.

- Raise your own food. Rather than paying hard-earned money at the store for eggs, poultry and dairy—raise them yourself. Chickens are very easy to care for and can provide you with meat and eggs throughout the year. Additionally, you can find substitutions for these peak foods with a little research and ingenuity. For example, rabbits would be a suitable protein replacement and can even be raised in more urban areas. Similar to chickens, they don’t require much care and with some effort can be fed from the homestead’s garden or you can grow fodder. They are also great breeders and will provide you with ample amounts of meat. These are the 10 best meat rabbit breeds. As well, for the modest price of purchasing a fishing license, you can stock your freezer with fresh-caught fish.

- It all adds up. Again, do what you can to pay off debts ahead of time and work to restructure your outgoing funds to lower your expenses as much as possible. Debt only enslaves you further, and finding ways to detach from the system will break those shackles. As well, look into finding additional income streams. The more income you can set aside, the better off you will be. That way, if your main income dries up, you have a fall back income and won’t have to go into default.

We Have a Choice

This economic crisis is projected to hit much harder than the 2008 recession and will last longer. The truth of the matter is that we stand at the brink of a precipice and the choice is yours to make: you can ignore the telltale signs or get ready and brace yourselves for it. It’s time to get ready because it’s about to get real.

It’s Martin Armstrong not Mark. While in prison at Ft Dix he wrote many papers for public viewing. His gf posted them on line. He has made several predictions claiming his computer told him so but never came to be. One was Gold $5000 Dec 2015, Russia collapsing, and the rising USD which he still stands by. After jail his tune changed. The point is we can only look at history and learn from that. This he does still drives home. If true then Govts do collapse along with their currencies. The US was so big it’s taking a little longer but it is surely in motion and getting ever close.

Thanks, Silverbug for pointing out that mistake and for your comments.

The “have nots” will want what you “do have” and they may be in the millions. Best not to tell anyone what you have and pretend like you don’t.

For instance if you try and sell or barter salt, plan on looking at the barrel of a gun, or worse, get shot. People will not be human when they are starving or dying.

usury never sleeps ..

US Published National Debt…$19,846,205,419,111

The Truth….$101,800,291,866,096

Your Share: $313,000 .

tytler cycle = 200 years