Tess,

About 18 months ago I sold our very large 5 bedroom home with a very large mortgage and moved to the lake. The good part is we made a small profit and leased the house we live in now. This way we are able to stay out of debt. We paid off all of out other debts and were able to save this last year and pay cash for a boat we keep at the marina. The boat was a few years old but in perfect condition. The prior owner of the boat had so many other big boy toys he could not use the all the time. He took the loss of depreciation. Our house at the lake is 1 block from the marina. We grew 3 raised gardens with organic soil and will add a 4th garden in the fall. The new location gives me and my son better and safer areas to ride our bikes. We are now able to ride our road bikes 45 to 100 miles from our front door on country farm roads. We have road bicycles and needed to be able to ride in the country with less cars. My son and daughter love going out on the boat. Also, a country club is a few miles from the house. Both of my kids love to golf. Our stress is so much better and enjoying being out of debt. we don’t mind renting our house. this gives us more freedom in our budget to enjoy travel, boating, golf and cycling. This move has been much better for my family and marriage. this change has given us freedom and a more care free life style. We are also, very involved in our church. My wife teaches Sunday school class for kids at the church and my daughter was recently baptized.

Now we are debt free do you have any other recommendations to us?

A reader

Answer:

Hello,

My apologies for not getting back to you sooner. Congratulations on simplifying your lifestyle. It sounds like you and your family are off to a good start. Getting out of debt is the #1 issue and you have made that a priority.

Now that you are out of debt, I would begin taking steps to saving and accumulating your income and later preserving your wealth through long term investments such as precious metals, and investing in hard assets. Another thought is to invest in land with resources such as water, soil, etc. This article on wealth preservation is a part of my 52 Weeks to Preparedness and a chapter in my newest book, The Prepper’s Blueprint, and can help you see the importance of wealth preservation. A plus to this type of investment, (especially precious metals and hard assets) is when you tie your extra money into these investments, you are less likely to cash that asset in. Therefore, it accumulates over time. This strategy has helped my family immensely.

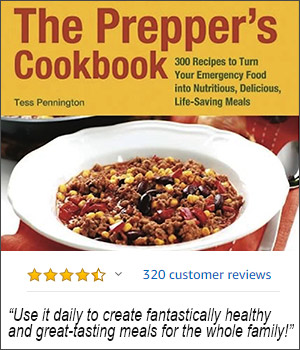

Further, you could invest in tangible assets such as shelf stable foods (wheat, corn, kitchen staples, etc.) Here’s a link to some foods that do well with long term storage. The reason I am suggesting these is that over time, food prices will continue to increase and having these available will help you save money over time and also be prepared for any long term economic issues.

I hope this helps. Once again, congratulations on the changes you have made to your lifestyle. It sounds like it has been a positive change and one that your family is on board with.

Take care and if you have any other questions, please don’t hesitate to ask.

Tess

This article was originally published at Ready Nutrition™ on June 26th, 2014