It’s no secret that America has a serious inflation problem. Though the Federal Reserve insists that our inflation rate is only at around .5%, we’ve all seen the price of food, rent, healthcare, and energy skyrocket over the past 10-20 years. However, this has been a gradual shift. Canada on the other hand, has just seen the price of every day goods rise precipitously over a very short period of time.

It’s no secret that America has a serious inflation problem. Though the Federal Reserve insists that our inflation rate is only at around .5%, we’ve all seen the price of food, rent, healthcare, and energy skyrocket over the past 10-20 years. However, this has been a gradual shift. Canada on the other hand, has just seen the price of every day goods rise precipitously over a very short period of time.

The crash in oil prices has crippled their economic growth, and led to the decline of the Canadian dollar, as well as a predictable increase in the cost of imports like food. For those of us living in the US, this provides a really good example of what life may be like should the dollar take a plunge in the near future. Here’s what our northern neighbors have been dealing with:

It is often said that a free-floating currency acts as a shock absorber.

But when Canadians go shopping for groceries these days, they’re getting nothing but the shock—sticker shock, that is.

On Tuesday, the Canadian dollar, commonly known as the loonie, broke below 70 U.S. cents for the first time since May 1, 2003.

For America’s northern neighbor, which imports about 80 percent of the fresh fruits and vegetables its citizens consume, this entails a sharp rise in prices for these goods. With lower-income households tending to spend a larger portion of income on food, this side effect of a soft currency brings them the most acute stress.

James Price, director of Capital Markets Products at Richardson GMP, recently joked during an interview on BloombergTV Canada that “we’re going to be paying a buck a banana pretty soon.”

Canadians took to twitter this week to share their collective horror over the rising cost of food. Cucumbers are $3 each. A head of cauliflower is $8. A large container of pepper cost $19 and some Canadians are paying $16 for a single bell pepper. A container of laundry detergent is $32.

This gives us a pretty good idea what would happen in the US, even if there was a minor shock to the value of the dollar. Despite the rising cost of goods and services, our currency has been doing really well on the global stage for the past two years. I shudder to think of what will happen when our economy runs into another recession, which we are way overdue for. When it does hit, the cost of our imports will rise the most, much like they have in Canada.

So what are our main imports? Fortunately, most of our food is homegrown, but there are quite a few American food staples that are also raised abroad, such as bananas, coffee, nuts, and seafood. And even though we’re one of the world’s largest meat producers, we still import a lot of pork and beef from Canada, New Zealand, and Australia. However, that doesn’t mean homegrown food wouldn’t become more expensive as well.

Even though we’ve become one of the world’s leading oil and natural gas producers in recent years, we still import a significant amount of oil from abroad. Since our agricultural industry is heavily reliant on oil, we could expect the price of all our foods, both domestic and imported, to rise.

If you want to understand how our economy would hurt from inflation or a dollar dump, take a look a this list of America’s biggest imports. We ship in a ton of electronics, which are worth about $315 billion per year. For a high-tech society like ours, this would be crippling.

The other items that stand out in that list are healthcare related. When put together, medical equipment and pharmaceuticals amount to 6.3% of our imports. Our medical system is already the most expensive in the world, so a plunge in the dollar’s value would make that situation significantly worse.

All told, a dollar dump would be really bad. That may sound obvious, but when it happens you can expect our government and media to tell us the same thing the leaders in Canada are trying to tell their citizens. Here’s how Steven Poloz, the head of Canada’s central bank, is trying to spin this situation.

Nonetheless, Mr. Poloz insisted that the Canadian dollar, which has plunged to near 70 cents (U.S.), is helping to offset the billions in lost revenue from exports of oil and other commodities. The drop makes Canada’s non-resource exports more competitive in world markets. A lower dollar is generally beneficial to exporters because they pay for their inputs, such as labour, in Canadian dollars, while their sales are generated in the higher U.S. dollar.

This is how all central bankers talk. They could find a silver lining in any situation, even if there was blood in the streets. They’ll say the same thing in the US when the next recession hits and the dollar slips. But it won’t change the fact that everything we need for our survival will be more expensive, and the average person will be making less (or no) money.

This article was originally published at Ready Nutrition™ on January 14th, 2016

No Nation Has EVER Taxed Itself Into Prosperity

You cannot legislate the poor into freedom by legislating

working Americans out of freedom.

What one person receives without working for, another person must work for without receiving. Government cannot give to anybody anything that government does not first take from somebody else. When half the people get the idea that they do not have to work because the other half is going to pay for them – and

when that paying half gets the idea that it does no good to work because

somebody else is going to get what they worked so hard for, then that, my friend, is the end of any nation. You cannot multiply wealth to help the poor by dividing it.

The Pilgrims learned that lesson at Plymouth Rock, yet here we are again, over and over, having to relearn it.

Not true only thing we get from us is veg and I have not noticed any change, might be few cents but that’s it, the rest like meat is Canadian meat and alas it was hight long ago.

Not true only thing we get from us is veg and I have not noticed any change, might be few cents but that’s it, the rest like meat is Canadian meat and alas it was hight long ago.

Well lets see Adam, Cauliflower, between 7 and 9 dollars depending where. Then celery, 6 dollars and oh what about broccoli at 3 dollars for a head half the size it regularly sold for. Carrots onions oh and 4 dollars for lettuce. Where are you shopping that you don’t see any change? Are you buying those Chinese veggies that are grown in contaminated soil? Are you buying Chinese fish that are raised in ponds flooded with the waste off the contaminated fields? The border guards in Vancouver say they cannot check even 10% of what comes in and W5 did a story on the contaminated foods from China on the Toronto market. Do you know what you are eating?

Where exactly do you live, that you pay those kinds of prices? I’m in Montreal and went grocery shopping just last night, paying 99 cents for an english cucumber, 3.49 for a pack of 4 bell peppers, 69 cents a pound for bananas and 1.99 for a celery. The carrots and onions are on sale 4 five pound bags for $5.00.

I live in Manitoba and bananas are 99c a pound… and I’m in the southwestern portion, not way up north.

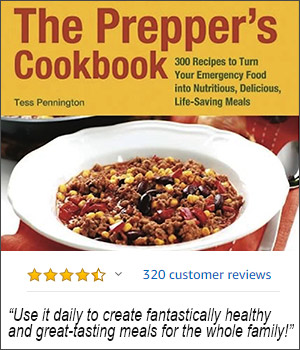

Hello Tess,

Here outside of Kitchener I can concur the prices of food. My wife works in a grocery store and the horror she sees is astounding. I am so glad I found your site many many moons ago. The food we put down has cut the cost of eating now. People refuse to look. It’s inflation they say. They have no idea what inflation is. Inflation is caused by the government and by them alone. The prices are simply the result of the inflation the government has created.

People of the United States had better Unite before there is nothing to Unite behind.

It struck me like a knife when I heard your president state,’ The United States is not a Christian nation”

That was a statement not an observation. Remember what Daniel saw in his dream of government. He saw a big dirty beast. Your White House has proven that vision correct.

Our president is a Muslim dictator or as I prefer, a Kenyan squatter. He is repulsive. I can’t look at him. I would rather gut road kill and crawl inside. The only positive side, he is so dysfunctional that even the blind are gaining sight.

Just a message from the Canadian prairies…

Yes, I paid $10 for a head of cauliflower…. but food prices have been steadily rising anyway. It’s no surprise. Just makes us better at food budgeting.