For several years now, many economic forecasters and trenders have warned the general public of a looming economic collapse – all we needed was a catalyst as a kick start. It seems that this year’s active winter season coupled with the west coast’s extreme droughts could be the straw that will break the camel’s back.

According to www.zerohedge.com, 2014 food prices are up 19%. In fact, “U.S. foodstuffs is the best performing asset this year.” Due to the crippling drought that swept the west coast, a significant amount of our food supply could not be grown. Consequently, our food prices are increasing because of the demand for food. The more events that cause instability in our economy, the harder it will be for households to provide for themselves.

Source – Zero HedgeStart Insulating Yourself from an Unstable Economy

Those who have taken steps to insulate themselves from the instability of the markets have made prudent choices to invest in their future through lucrative investments. Dry goods, precious metals, land and skills are some of the hard assets that many economist such as Gerald Celente and Marc Faber stress.

While the ramifications of an impending economic or currency collapse are life alteringly severe, my family’s personal preparedness plans have always been focused on a well-rounded approach that would ensure we’re ready for anything that gets thrown our way – not just an economic crisis. The strategy that we try to employ considers as many variables as possible.

- Natural disasters such as hurricanes, earthquakes, flood, solar flare

- Man-made calamities like currency hyperinflation, cyber-attack, EMP detonation, nuclear fallout or global conflict

- Personal emergencies like a job loss, injury or over-extension of credit

Preparing for these type of setbacks require a bit of organization, a plan of action, necessary investments such as preparedness supplies and long term investments (hard assets such as food, land, precious metals, etc.), and a controlled financial budget. I have created a 52-Week preparedness program that will help lay out the fundamentals of my family’s approach to preparedness. To insulate yourself from longer term events such as currency hyperinflation and global conflicts, you want to focus your efforts on the following.

- Get out of debt. Those in Washington believe the debt crisis can be inflated away. We don’t have the luxury to thing this way. In fact, they are making a common mistake that many households make. Ihey are failing to see the signs that their financial budgets are skewed. By ignoring the problem, they have put our well being in jeopardy. Pay attention to what is going on in the economy: the the economy is stagnant, jobs are becoming scarcer, the middle class is dwindling and now food prices are beginning to sky rocket that will no doubt bring you hardship later on. This is not signs of a thriving market and certainly no time to carry debt, so start taking steps to eliminate it while there is still time. Downgrade your cable package, drastically cut unnecessary spending, start cooking homemade-from-scratch dinners (you’ll save money and will use your food pantry investment.

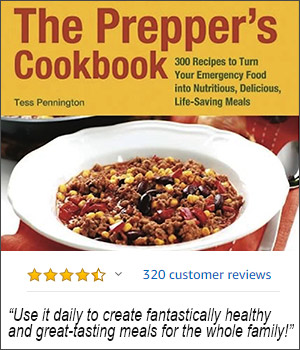

- Invest in an emergency pantry. Did you know that nearly 23% of your grocery bill is spent on processed foods and sweets? Rather than spending it on GMO filled junk, you can use that money to invest in a food pantry. One of the best decisions my family made into our future livelihood was to eliminate our debt by simplifying our lifestyle, and by creating a food pantry based on the 25 most popular pantry goods. We looked at purchasing our foodstuffs as an investment and knew this common sense approach is what would help us stay afloat if we ran into financial or economic issues. Through this small investment of time and resources, we are consuming today at yesterday’s prices.

- Grow a garden. If food prices are rising, this is the time to grow your own food. Not to mention reduce your intake of chemical fertilizers and GMO foods by creating an organic garden filled with heirloom quality fruits and vegetables. I am a firm believer of knowing where your food source is coming from. Likewise, heirloom seeds are an invaluable commodity and hold the key to long term sustainability – and survival, in some cases. Investing in these meager seeds can hold the power to sustained longevity and health.

- Invest in precious metals. If you have the money to invest, precious metals are a very lucrative investment that will retain their value. Throughout the history of man, precious metals are what has made the world go around. Many start their precious metal collection buying junk silver and silver coins. Silver allows you to make modest, weekly investments of anywhere from $5 to $50 dollars and still build a store of wealth. A single ounce of gold stores more value than silver. If you need portability for a large amount of wealth, gold coins and bars will be your primary precious metals investment. With less than a pound of coins in your purse or backpack you can conveniently move $25,000 in value. When buying gold or silver, buy from reputable sources like your local coin shop or an online dealer like Apmex or Kitco. Read more about this type of investment.

- Purchase fertile land. Trend forecaster Gerald Celente is an advocate of self-sufficiency and the survival mentality. Marc Faber and Jim Rogers have suggested that buying farmland and learning to work that land will not only make you rich in the future, but help you to provide for yourself. These economists, forecasters and financial advisors are not just blowing smoke and arbitrarily recommending you learn to be more self-sufficient. They see a trend, globally, and that trend suggests an inflationary environment that will not only cause increased prices for essential goods, but the possibility that those essential goods you are used to acquiring with little effort today will be much more difficult to come by in the future.

- Start a bartering community. Given our free falling economy, what better way to trade skills and save a dollar than by the barter system? This is also a great time to branch out into the community with likeminded individuals. Look into barter groups in your area and check out these tips to help you barter better.

It’s Not If, But When

We’ve all heard the reports and seen the tell-tale signs of the storm brewing on the horizon. As a whole, we cannot continue to bury our heads in the sand and ignore the ever-growing issue of our economic instability. Start taking steps to lead a more self-reliant lifestyle and invest into your future wellbeing. The tips provided above can help you gain a greater edge in readying yourself for the uncertain future.

This article was originally published at Ready Nutrition™ on March 27th, 2014