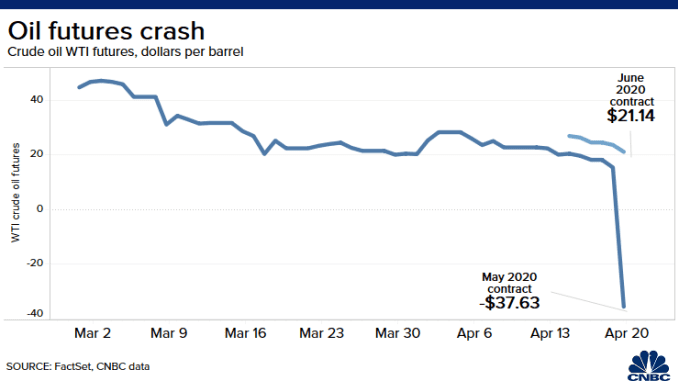

There is a new cog in the failing machine. We watched as COVID literally put a stop to the airline industry, car, shipping, and trucking traffic as well as manufacturing production thus severely limiting the demand for oil. As a result, U.S. crude oil prices dropped nearly 300 percent and turned negative for the first time. To put it into context think of it like this, it means that the barrel of the oil is worth more than its contents and the fact that oil is used as an economic forecasting tool could mean the demand for oil is drying up.

One article states:

“When oil prices are negative, it means traders holding oil futures are paying buyers to take it off their hands or risk having to take physical delivery of the oil, which most are incapable of doing. Oil is still a valuable commodity, but the selloff followed a huge oversupply in the market after major producers refused to lower their output creating fewer places to store the liquid.”

When oil prices are negative, it means traders holding oil futures are paying buyers to take it off their hands or risk having to take physical delivery of the oil, which most are incapable of doing. Oil is still a valuable commodity, but the selloff followed a huge oversupply in the market after major producers refused to lower their output creating fewer places to store the liquid.

Oil is sold through futures contracts, which means there is a gap between the contracted price and the spot price paid at it actual delivery date. The contracts for May were set for Tuesday, April 21 and that pricing gap grew as more traders anticipated demand would not return until at least the fall, resulting in a historic sellout. Monday’s price was the lowest at least since records started being kept by BP in 1861.

Another writer explains just how devastating this is to our economy.

Seriously though, 20% of the American economy just went 100% into the shitter. Businesses will fail. Mortgages will go unpaid. Rents will be abandoned. And that’s on top of the Chinese Virus garbage which has killed restaurants and retail. If anyone has visited Central and West Texas one would understand just how integrated oil is into the Texas economy.

Now multiply that time every state in the region. Oklahoma will have no reason to keep fracking. Louisiana’s offshore rigs are now totally unprofitable. Arkansas, Pennsylvania, Ohio, the Dakotas and every other state which experienced budget surpluses are about to become as vulnerable as Illinois, New York, or New Jersey as revenues evaporate.

And that doesn’t even start to address the problem.

The Great Reset

We are literally watching a TEOTWAWKI event transpire right before our eyes. By all accounts, the pandemic was the triggering event that will set off a breakdown of epic proportions. As the COVID-19 pandemic opened our eyes to a worldwide health crisis, what could ensue will shake us to our core.

There is no mistaking the signs of economic instability. Turmoil in the stock markets, mass job loss, and cost of living have been at the forefront of our minds dealing with the aftermath of COVID, but now we are literally living in a world where there is a battle for resources from a country level to a world level. Borders are temporarily closing. Resources are getting scarce. Most people do not understand this is the fall of a civilization.

There is a reset planned and we are in a very vulnerable position. Our manufacturing is down, our resources are limited, and populations of people around the world are unable to care for their households. Mark my words, this reset will come at a great cost and all rules that currently apply go out the window in times such as these. At the rate we are currently going, at some point, the system will seize up and eventually will just stop.

What to expect is to expect the unexpected because uncertainty is the name of the game. We don’t know how far markets will crash, what will happen with the U.S. dollar or what will happen with geopolitical tensions; and our way of life could change literally overnight. In the last 15 years, we’ve seen what systemic breakdown does in countries like Greece, Cyprus, Venezuela and, Argentina.

The lessons learned are clear – you better have supplies on hand. In Venezuela, for example, they couldn’t even get toilet paper or condoms. In Greece, people were lining up in droves to get expired food that grocery stores were throwing away, and perhaps just as significantly, access to lifesaving medicine was lost when Greek credit markets were locked up.

The reality is stark and the consequences are clear – there will be panic, confusion, and violence. Are you ready for that?

When this happens, the standard of living to change. Long gone will be the days of disposable incomes. America will not fare well in this case simply because we are so used to an easy style of living and suffering has not been a part of our life since World War II.

Preparing for Economic Collapse

In times such as these, it is imperative to get out of as much debt as possible. Sell equities, real estate, most bonds, commodities, collectibles. In an economic depression, “cash is king” as average joes like you and I will not be able to depend on credit to get the things we need. Instead of focusing on debt and credit, pay attention to your liquid assets.

Peter Schiff, who accurately predicted the 2008 recession has come out and declared we will all live through another Great Depression, only this time, it’ll be much worse than before.

“The bad news is, we are going to live through another Great Depression and it’s going to be very different. This will be in many ways, much much worse, than what people had to endure during the Great Depression…This is going to be a dollar crisis.”

“When you are talking about the magnitude of the debt we have, that extra money [raising interest rates] is big. That’s going to be a big drain on the economy to the extent that we have to pay higher interest to international creditors…a lot of this phony GDP is coming from consumption, while the average American who is consuming is deeply in debt and they are going to impacted dramatically in the increase in the cost of servicing that debt…given how much debt we have, and how much debt is going to be marketed the massive increase in supply will argue for interest rates that are higher.” -Peter Schiff

In a true collapse, people will begin to realize they need to start looking at longer-term options to survive. There will be an abrupt need for more sustainable approaches to living. Therefore, concentrate your efforts on safe-haven assets that promote long-term self-sustainability such as investing in hard assets, farmland, tools, farm equipment or precious metals.

- Preserve wealth. Choose hard assets (dry goods, precious metals, land, livestock, skills, etc.) for long-term investments so they will hold their intrinsic value over time. Holding these types of investments will insulate you from inflation and other economic issues. Further, tying your money up in assets will help you avoid the inflating prices of food sources in the future, thus furthering your cause of self-reliant living.

- Invest in food. One thing analysts and financial pundits agree on is that, in general, commodities will continue to rise. When others are buying foods at inflated prices, you will be consuming your investment when it was purchased at a lower price. Using a combination of shelf-stable foods, you can create a well-rounded food supply to depend on when an emergency arises. Further, these foods last a lifetime and would make sound investments for future planning. Ideally, you want to store shelf-stable foods that your family normally consumes, as well as find foods that are multi-dynamic and serve many purposes. Dry goods like rice, wheat, beans, salt, honey, and dry milk will provide you with an investment that will grow in value as prices rise, and also offer you peace of mind in case the economy further degrades.

- Learn how to grow your own food. With fears of food price inflation, take control of your food sources and start finding a way to grow and raise your own food sources. Independent food security will be paramount in surviving an economic collapse. Investing in heirloom seeds is an invaluable commodity and holds the key to long term sustainability, and survival in some cases. Seeds could be used as a form of currency in a long-term disaster and used in a bartering system. A long-term event could potentially increase its value tenfold. They would also be beneficial to have during an inflationary period. If you have heirloom seeds to grow fresh produce, then the plants are continuously producing more seeds for future growing seasons. If you don’t have to buy produce, then you are saving hundreds of dollars a year on your grocery budget. As well, they can also be sprouted to eat for added nutrition and vitamin intake. These are some of the most popular seeds to have. Moreover, if you really want these peak foods, find a way to grow them yourself. Further, if you live in a rural area, consider investing in trees and bushes that will lure wild game. The trees and bushes can provide you with added sustenance and help you stock meat in your freezer.

- Raise your own food. Rather than paying hard-earned money at the store for eggs, poultry and dairy—raise them yourself. Chickens are very easy to care for and can provide you with meat and eggs throughout the year. Additionally, you can find substitutions for these peak foods with a little research and ingenuity. For example, rabbits would be a suitable protein replacement and can even be raised in more urban areas. Similar to chickens, they don’t require much care and with some effort can be fed from the homestead’s garden or you can grow fodder. They are also great breeders and will provide you with ample amounts of meat. These are the 10 best meat rabbit breeds. As well, for the modest price of purchasing a fishing license, you can stock your freezer with fresh-caught fish.

- It all adds up. Again, do what you can to pay off debts ahead of time and work to restructure your outgoing funds to lower your expenses as much as possible. Debt only enslaves you further, and finding ways to detach from the system will break those shackles. As well, look into finding additional income streams. The more income you can set aside, the better off you will be. That way, if your main income dries up, you have a fall back income and won’t have to go into default.

While there are a lot of moving parts and it’s hard to see what the end result will be. But the battle for resources from an individual level to a national level to a world level is becoming more clear. Mark my words – economic changes are coming and when they do, they will be hit much harder than the 2008 recession and will last longer. The truth of the matter is that we stand at the brink of a precipice and the choice is yours to make: you can ignore the tell-tale signs or get ready and brace yourselves for it. It’s time to get ready because it’s about to get real.

I fear the great tribulation period is upon us. Lord save us all!

Oil prices didn’t plunge merely in response to this virus. They plunged because Russia and Saudi Arabia are at war over market share, and they’re both pumping out oil as fast as possible.

That much being said, I swear by the solutions offered, 100000%. If I may add something, maybe we could get some extra gas cans, and store some by while the price is so cheap. There’s this stuff called Stay-bil that keeps it from going bad, so get some of that too.

Just an idea